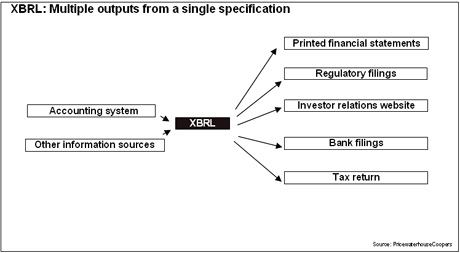

XBRL is now the standard for transmission of financial information between the most important regulators in the financial market and banking supervision institutions. XBRL simplifies the processes of collecting information and processing it due to the reason every little piece of data is tagged for the data transmission and each concept used is documented in the taxonomy. The data can be validated on the receivers side and on the senders side. On the other side, XBRL is a royalty free standard that allows regulators to be isolated from the information systems on the data preparers side.

|

The XBRL reporting process has advantages over the way reports are assembled and distributed today because XBRL allows for:

- Lower preparation cost

- Reduced preparation time

- Broader information availability

- Adaptability to changing reporting requirements

- Enhanced analytical capabilities

- Increased transparency

Who is using XBRL? at this stage the list of public institutions using XBRL is so large that there is no a single point where all data can be collected. The following link: http://www.xbrlwiki.info/index.php?title=XBRL_PROJECTS would give you an idea about.

The methodology used by Reporting Standard for projects in public institutions consist on splitting the project in two phases:

During Phase 1: An XBRL Taxonomy is created for the exchange of information between the regulator and the regulated entity.

The project on phase 1 contains 5 sub phases

- XBRL Training

- Show case

- Taxonomy development using Excel

- Taxonomy modularization and test cases

- Documentation and acknowledge by XBRL International

During Phase 2: the digital reporting platform is configured according to the project needs.

The sub phases of phase 2 are

- Analysis of the technical infrastructure and collection of business requirements

- Set up of the products in the platfrom according to project needs

- Parameterization of the software components and building of the user interface according to regulator needs

- Platform Testing

Contact us for more information.